U.S. banking giants are anticipated to report lower fourth quarter profits this week as lenders increase rainy-day funds in anticipation of an economic slowdown that is hurting investment banking.

On Friday, JPMorgan Chase & Co, Bank of America Corp, Citigroup Inc, and Wells Fargo & Co will all release their quarterly financial results.

The six biggest lenders, including Goldman Sachs (GS.N) and Morgan Stanley (MS.N), are anticipated to accumulate a combined $5.7 billion in reserves to cover soured loans, on average, according to Refinitiv projections. That is more than twice as much as the $2.37 billion set aside in the previous year.

Banks “will likely incorporate a more severe economic outlook” this year, according to Morgan Stanley analysts led by Betsy Graseck. “Most U.S. economists forecast either a recession or significant slowdown this year,” they wrote.

In an effort to contain inflation that is approaching its highest level in decades, the Federal Reserve is aggressively raising interest rates. Consumers and businesses have reduced their spending as a result of rising prices and rising borrowing costs, and since banks act as economic intermediaries, their profits fall when activity slows.

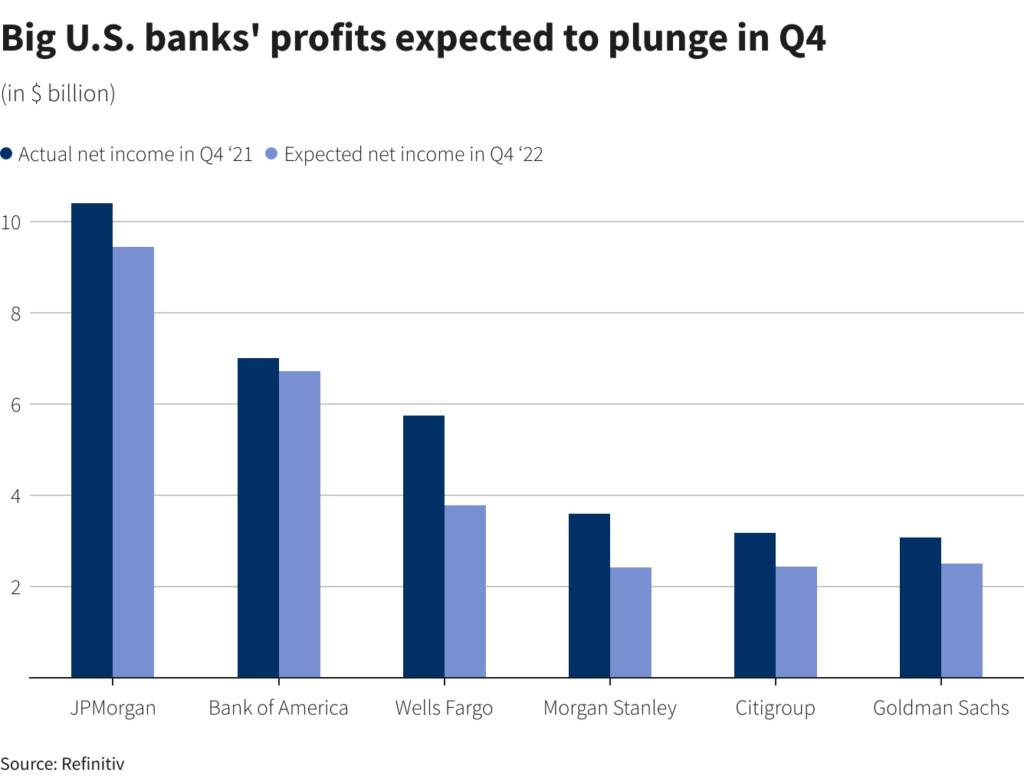

According to early analyst projections from Refintiv, the six banks are also anticipated to report an average 17% decline in net profit in the fourth quarter compared to a year earlier.

Lenders will benefit, however, from rising rates because they will be able to charge borrowers more in interest.

Investors and analysts will pay close attention to bank executives’ commentary as a key indicator of the direction of the economy. Many executives have expressed concern in recent weeks about the more challenging business climate, which has led companies to reduce pay or eliminate jobs.

Thousands of employees at Goldman Sachs will begin losing their jobs starting on Wednesday, according to two sources familiar with the plan. A decline in investment banking activity led to job cuts at a number of other companies, including Morgan Stanley and Citigroup.

The actions follow a sharp decline in business for Wall Street dealmakers handling mergers, acquisitions, and initial public offerings in 2022 as rising interest rates roiled the markets.

According to data from Dealogic, global investment banking revenue dropped to $15.3 billion in the fourth quarter, a more than 50% decrease from the same quarter last year.

Results from banks will also be heavily focused on consumer businesses. While consumers are generally in good financial shape, more are starting to fall behind on payments. This is because household accounts have been supported for a large portion of the pandemic by a strong job market and government stimulus.

According to David Fanger, senior vice president of Moody’s Investors Service’s financial institutions group, “we’re exiting a period of extraordinarily strong credit quality.”

Results at Wells Fargo will continue to be impacted by regulatory fines and the fallout from the fake accounts scandal.

After agreeing to settle allegations of widespread mismanagement of auto loans, mortgages, and bank accounts with the U.S. Consumer Financial Protection Bureau, the lender anticipated recording an expense of about $3.5 billion, the largest-ever civil penalty imposed by the watchdog.

Analysts will also keep an eye on any write-downs that banks like Morgan Stanley and Bank of America make on the $13 billion loan used to finance Elon Musk’s acquisition of Twitter.

More generally, the KBW index of bank stocks (.BKX) is up about 4% this month after falling nearly 28% in the previous year.

Despite the sharp shift in market sentiment from optimistic to fearful in 2022, some sizable banks may be able to defy the worst scenarios because they have cut back on risky ventures, according to Susan Roth Katzke, an analyst at Credit Suisse.

After a decade of de-risking, “we see more resilient earning power through the cycle,” she noted in a note. “We cannot ignore the underlying power.”